How to Get Funding for Small Business: Complete Guide for Entrepreneurs

Getting funding for a small business is one of the biggest challenges many founders face. Whether you’re launching a new idea or expanding your existing company, the proper financial support can help you grow faster. In this guide, I’ll walk you through how to get funding for a small business, the best funding options, and how to prepare so lenders and investors say “yes.”

Why Small Businesses Need Funding

Small business funding plays a vital role in:

- Starting operations

- Buying inventory or equipment

- Hiring employees

- Marketing and promotion

- Opening new locations

- Managing cash flow

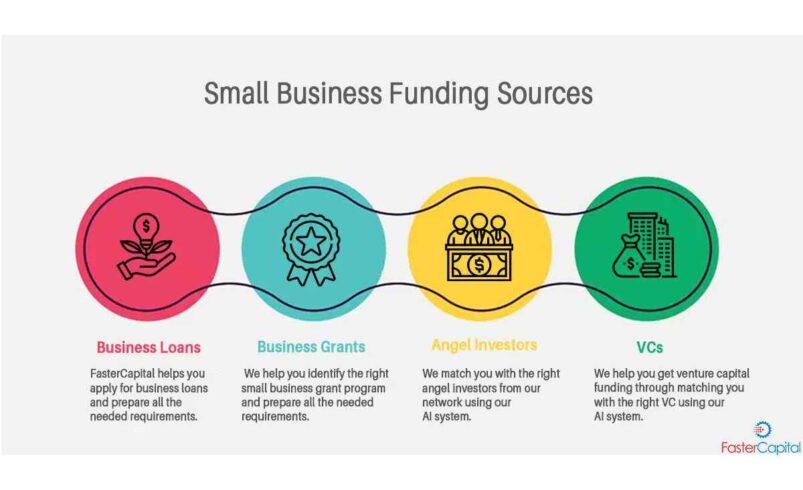

Types of Funding Options for Small Businesses

There are multiple ways to raise capital. Each option suits different business needs, so choose the one that fits your stage and goals.

Bootstrapping (Self-Funding)

Bootstrapping is when entrepreneurs use their own savings to build their business.

Benefits:

- No loans or interest

- You retain 100% ownership

- Quick to start

Best for new businesses with low initial costs.

Bank Loans

Bank loans are one of the most common ways to fund a small business.

Pros:

- Lower interest rates

- Suitable for large funding requirements

Cons:

- Strict eligibility criteria

- Requires collateral in many cases

Increase approval chances by maintaining a strong credit score and preparing a well-crafted business plan.

Government MSME Loans

Many governments offer special loan schemes for small and medium businesses.

Popular examples (India):

- Mudra Loan (PMMY)

- CGTMSE Scheme

- SIDBI Loans

These loans often offer lower interest rates and collateral-free options, making them ideal for micro and small businesses.

Angel Investors

Angel investors are individuals who invest in early-stage startups.

What they look for:

- Innovative business idea

- Strong potential for growth

- Dedicated founding team

You may need to give up a percentage of equity, but you gain mentorship and guidance.

Venture Capital Funding

VCs invest in high-growth startups, especially in tech, e-commerce, and SaaS.

Advantages:

- Large funding amounts

- Business expertise and networking opportunities

Downside:

- High competition

- Loss of some ownership control

Crowdfunding

Crowdfunding platforms allow you to raise money from a large number of people online.

Popular platforms:

- Kickstarter

- Indiegogo

- Ketto

- GoFundMe

Crowdfunding works best for businesses with a unique product or a compelling story.

Business Grants

Grants are one of the best funding options because they don’t require repayment.

Common grant categories:

- Women-led businesses

- Tech and innovation

- Social impact businesses

Peer-to-Peer Lending

P2P lending connects borrowers directly with individual lenders through online portals.

Benefits:

- Faster approval

- Less documentation

- Flexible repayment terms

How to Prepare Before Applying for Funding

Preparation can make or break your funding application. Here’s what to do:

Create a Strong Business Plan

Your business plan should clearly explain:

- Your business idea

- Target audience

- Revenue model

- Competitor analysis

- Financial projections

A convincing business plan shows that you know what you’re doing.

Organize Your Financial Records

Lenders and investors will carefully review your financials.

They typically check:

- Bank statements

- GST returns

- Profit and loss statements

- Balance sheets

Clean and transparent records increase trust.

Improve Your Credit Score

Whether personal or business, a good credit score boosts your approval chances.

Improve it by:

- Paying EMIs on time

- Reducing credit utilization

- Limiting multiple loan applications

Calculate the Exact Funding You Need

Don’t ask for random numbers. Calculate:

- Startup costs

- Inventory or equipment needs

- Marketing budget

- Emergency funds

This helps lenders see your planning capability.

Build a Pitch Deck (For Investors)

A pitch deck is essential if you’re approaching angel investors or VCs.

It should include:

- Problem your business solves

- Market size

- Business model

- Traction (if any)

- Financial forecast

- Team introduction

Best Tips to Get Funding Faster

Here are innovative ways to improve your chances:

- Register under MSME for more benefits

- Compare loan interest rates before applying

- Build business credit early

- Keep revenue consistent

- Strengthen your online presence and brand

- Start with smaller loans and scale up

Which Funding Option Should You Choose?

Here’s a quick guide:

| Business Stage | Best Funding Options |

| New Startup | Bootstrapping, Crowdfunding, Angel Investors |

| Growing Business | Bank Loans, MSME Loans, Revenue-Based Financing |

| High-Growth Startup | Venture Capital, Angel Investors |

| Social or Impact Business | Grants, CSR Funding |

Final Thoughts

Understanding how to secure funding for a small business becomes easier when you know your options and prepare thoroughly. Whether you choose a bank loan, government scheme, investor funding, or crowdfunding, the key is to show confidence, clarity, and a strong growth plan. With the proper steps, securing small-business funding becomes much more achievable.